An analysis of tariff data by Tap Electric in 2,617 neighborhoods in the Netherlands has shown that there is a significant price difference of 14.3 euro cents between equivalent chargers in any given neighbourhood.

This could cost the average EV driver an additional €365 per year to charge their car, with high mileage drivers feeling significantly more.

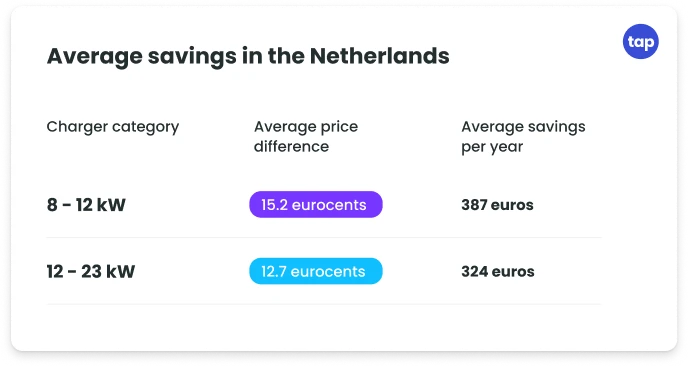

The research shows that the difference is even clearer in the category of chargers from 8 to 12 kW, with a difference of 15.2 euro cents between the most expensive and cheapest charger within walking distance of each other.

Average savings based on an efficiency of 17 kWh/100km [1] and annual mileage of 15000kms, an average person charges around 2550 kWh/year

Nico Spoelstra, CEO of Tap Electric, doesn’t think this trend is going away any time soon.

“5 years ago, if you owned an EV then you paid more or less the same cheap rate for electricity all over the country. Nowadays, for various reasons in the macro ecosystem, and especially since the 2022 energy crisis, we see really significant price swings within small geographical areas.”

There are a number of reasons for the price differences within neighbourhoods.

First, private companies are awarded the right by local governments to operate charging networks within their regions. The networks are tendered out over time in such a way that the different operators may overlap within a neighbourhood. As a result drivers get similar infrastructure at different pricing levels. Energy is often purchased by operators in advance, and energy markets have seen big swings depending on the moment of purchase.

An increase in privately managed infrastructure is also a contributing factor.

Spoelstra says, “Thanks to platforms like Tap Electric, it’s easier than ever for businesses and individuals to make their charging infrastructure public. This can be at their retail shop, office building, or even their own driveway. But it also can mean drivers are leaving money on the table if they are not aware of different prices available in the neighbourhood.”

Spoelstra encouraged all drivers to stay informed of their options.

“If I can give drivers one piece of advice, it’s to get yourself a good app that clearly shows pricing in the area you are looking to charge in. With the Tap Electric app we offer this service for free and you know exactly where your money is going every time you charge.”

Source: Tap Electric Netherlands Tariff Analysis, September 2023

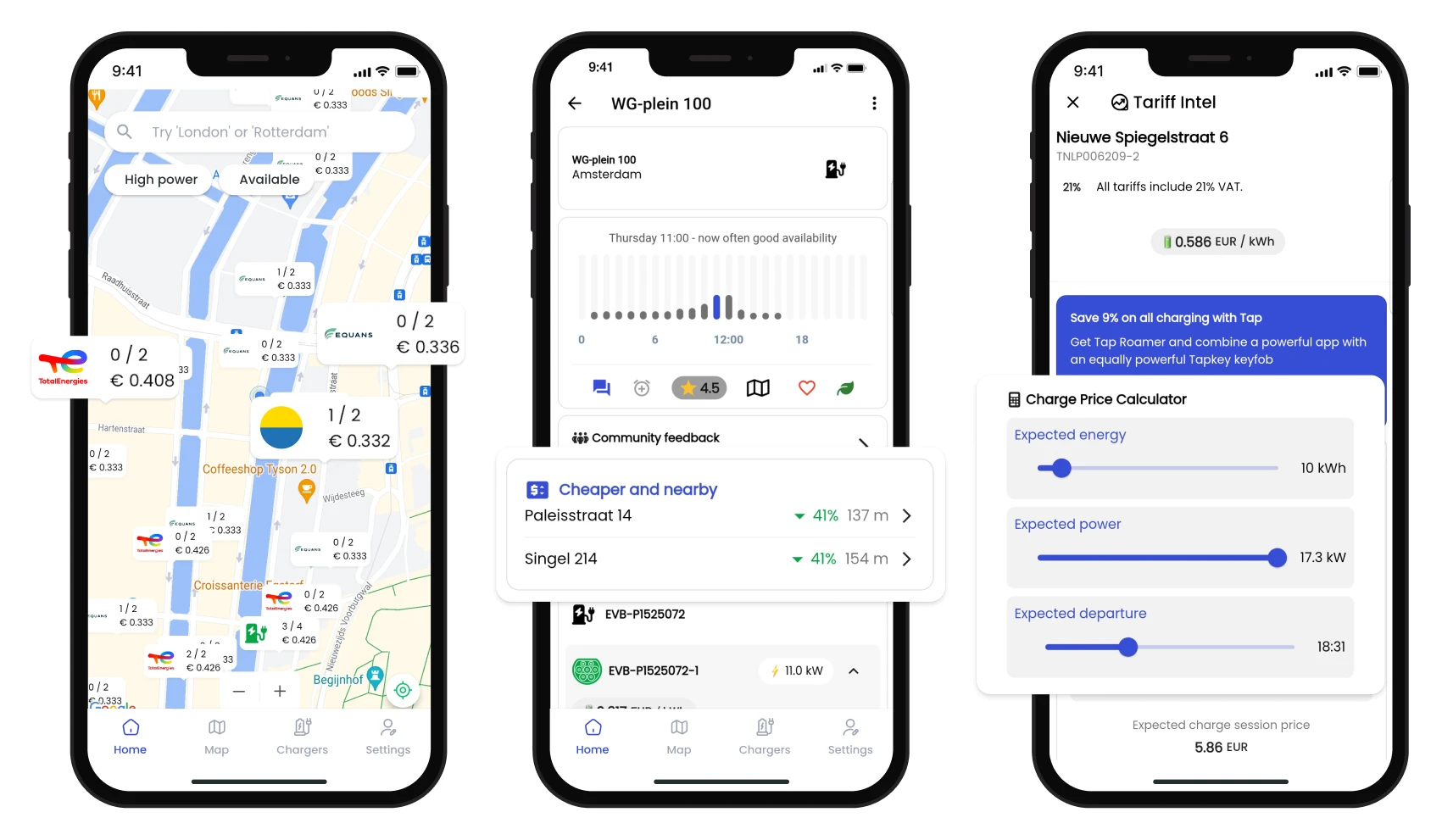

The Tap Electric app has a suite of features aimed at making pricing (and local price differences) more transparent.

- Pricing Map: shows charger pricing directly on the map for quick reference in your neighbourhood.

- Cheaper and nearby alerts: if you are about to start a session at a more expensive charger in your neighbourhood, the app alerts you that you can save money down the street.

- Tariff Intel: A detailed breakdown of how tariffs are built up so drivers can understand exactly what they are paying for.

Research methodology:

The data sample was taken from live tariff data of public chargers on September 24th 2023 excl VAT.

Only tariffs with solely a kWh were analysed for comparison. A total of 77.607 charger tariffs were included in the research.

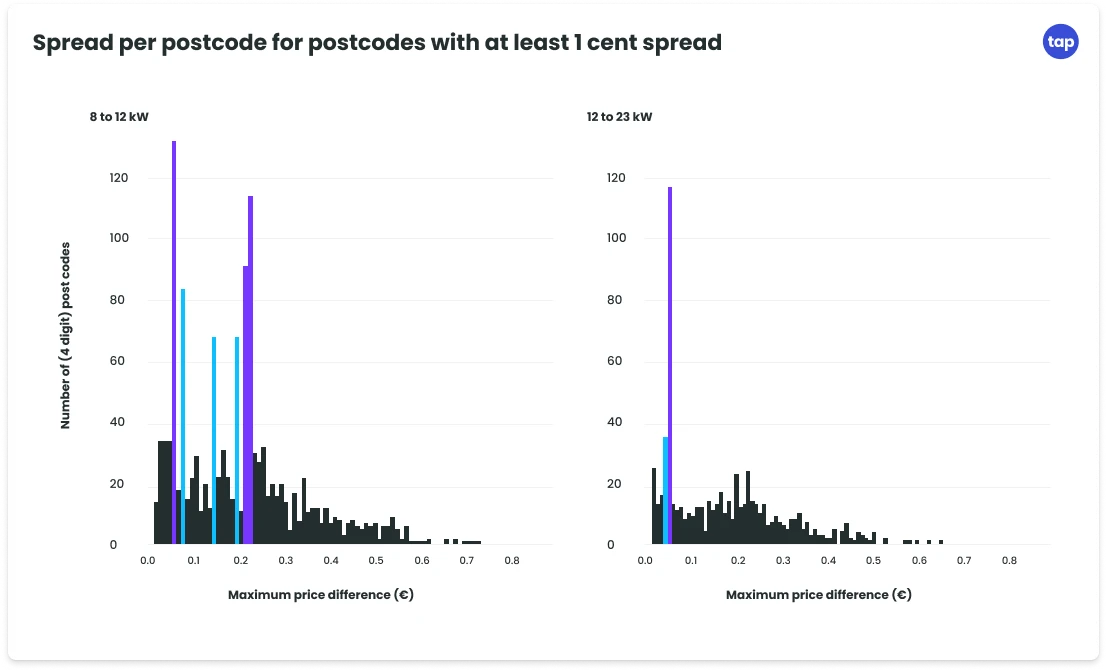

Tariffs were grouped based on the power range of the chargers, with most chargers falling in either the 8 to 12 kW and 12 to 23 kW groups.

Tariffs were grouped based on the first 4 digits of their location’s post code which in the Netherlands represents approximately one neighbourhood. In dense urban areas this certainly represents a walkable area; in less dense area, this are would more likely be driving distance.

Only post codes with at least 8 chargers were analysed (with the eception of the heatmaps, which include all data for complete visualisation).

All pricing analyzed is CPO pricing, meaning the research did not consider MSP business models.