Check is a leading Dutch shared mobility company focused on convenient and sustainable urban and regional travel. Their fleet includes electric cars and mopeds. Check’s car-sharing service supports trips beyond the city, such as visits to furniture stores, beach outings, or weekend getaways. Their electric cars can accommodate up to five passengers and ample luggage.

Check provides an RFID charge card in the vehicle so the user can recharge after their ride. The next renter can then use that same card to stop the charging and be on their way.

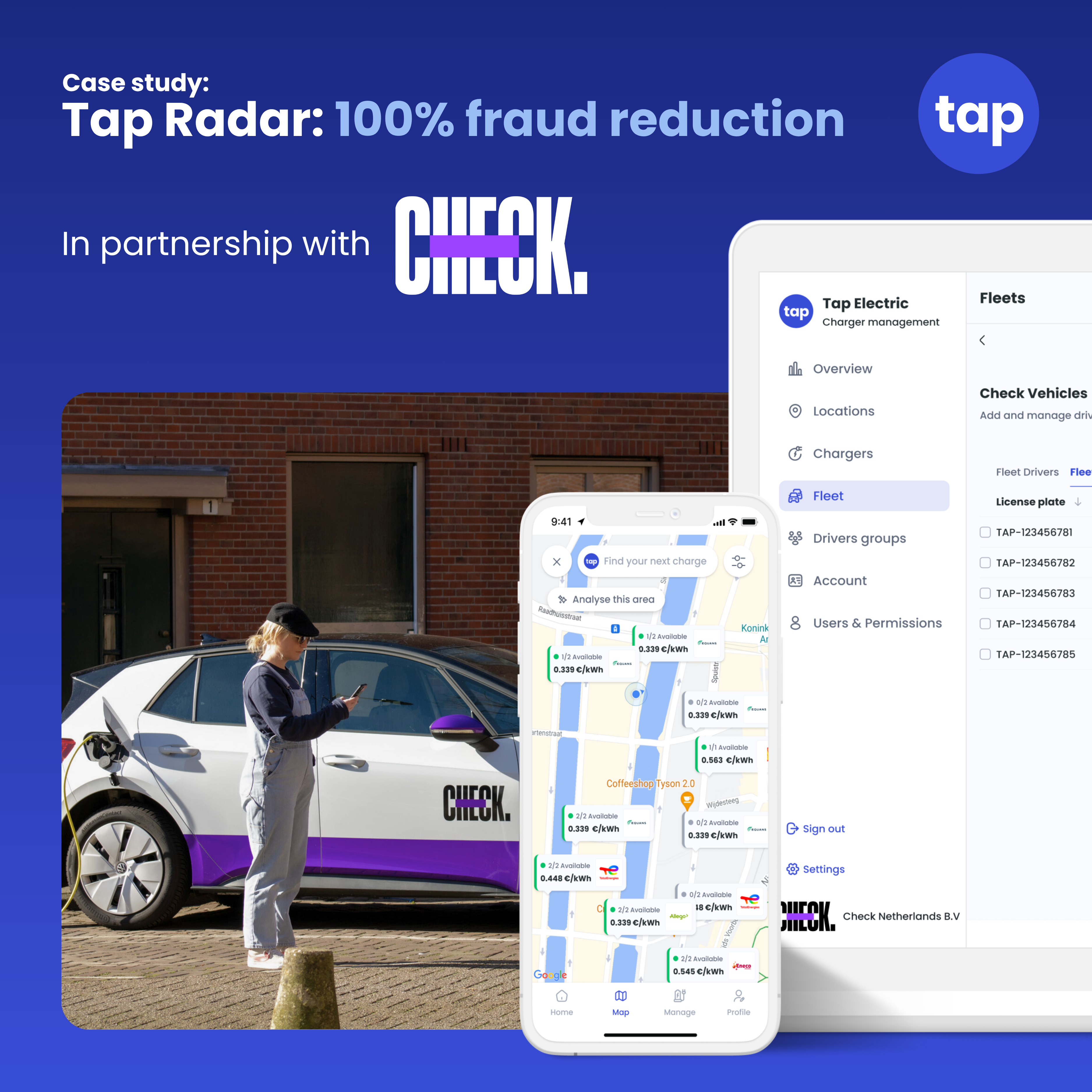

Unfortunately, like many parties in the e-mobility sector, Check saw a sudden spike in EV charging fraud in 2025. Because their charge card vendor had no anti-fraud technology in place, Check found themselves exposed. Check therefore partnered with Tap Electric to combat fraud.

The results

The Challenge:

A surge in EV charging fraud

Fraudsters were entering Check’s vehicles and “cloning” their charge cards. These duplicated cards were then sold on the black market, promising free charging for buyers. Of course, the charging is not free – Check was racking up huge bills due to these fraudulent cards.

What is RFID charge card cloning?

RFID is a convenient technology where an EV charge card’s embedded chip communicates with a charger, allowing drivers to simply tap to start and stop a charge session. Transactions started with an RFID card are also much cheaper to process than ones started on an expensive credit card terminal. This helps keep costs down for drivers and operators.

However, there is a serious downside with RFID cards: they are highly insecure and susceptible to cloning. Scammers use illegal yet readily available scanner devices to copy a card’s unique ID and create duplicate cards. Since drivers and fleet managers have their RFID card linked to an account with a payment method, this amounts to a huge security breach. Especially if a single card is duplicated more than once, fraudulent charges can accumulate into thousands of euros very quickly.

The Tap Electric solution:

Detecting stolen cards and stopping fraudulent transactions in real-time

Facing substantial financial losses, Check urgently needed a solution. This led them to partner with Tap Electric, a pioneer in EV charge card security. In 2021, Tap launched the Tapkey, the world’s first two factor authentication (2FA) enabled charge card. This feature alerts you via a push notification in the Tap app whenever your Tapkey is used at a location you’ve never charged at before. If you do not recognise the request to start a session, you can immediately decline it and have your Tapkey blocked and replaced.

Since the release of the Tapkey, Tap has further developed its anti-fraud technology. Today, that product is called Tap Radar, and it runs across every single user account and charging session on the platform. Trained on hundreds of parameters and powered by AI, Tap Radar detects suspicious patterns and stops fraudsters in real-time. This helps safeguard transactions for both consumers and fleet managers for all of their charging.

So when Check approached Tap to seek collaboration on their fraud issue, the two teams got to work. There was time pressure, as Check was facing fraudulent charging sessions each day, and the fraudsters were getting more aggressive. Luckily, both teams were able to move fast.

Tap integrated Check’s existing in-vehicle telematics data into its advanced Tap Radar technology. Now, every time a Check charge card (powered by Tap) is swiped on a charger, Tap can instantly verify the vehicle’s location against the charger’s location. Tapkeys were quickly deployed across Check’s entire fleet and the EV fraud situation was brought under control. Fraud dropped by 100%!

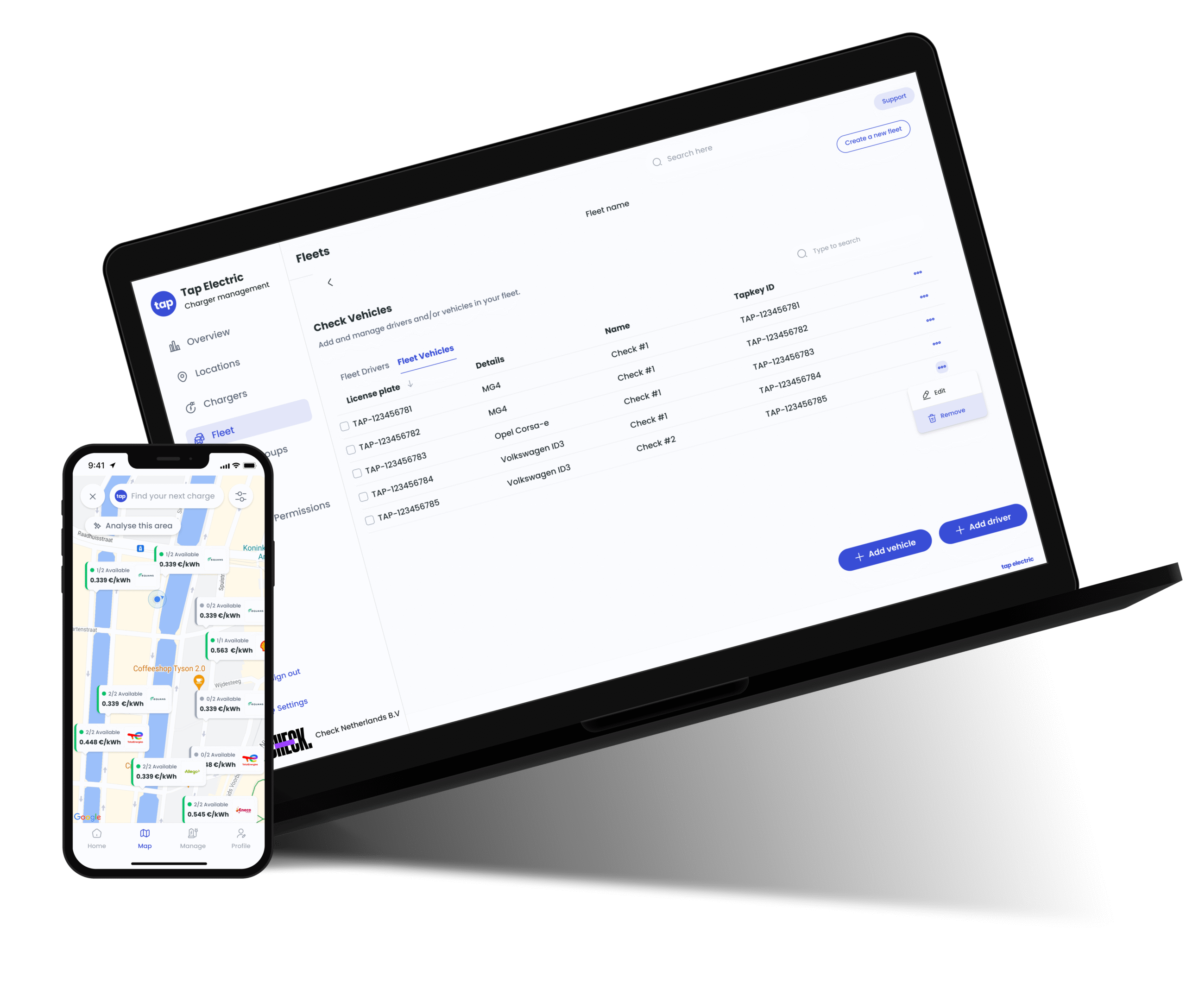

In addition to Tap Radar, Check can also take advantage of Tap’s advanced fleet features:

-

Platform API:

Provides comprehensive reporting for detailed insights into spend and usage patterns. -

Cost controls:

Enables fleet managers to set budget limits per fleet or per individual vehicle. -

Network controls:

Allows management to enable AC or DC chargers only, or choose specific networks to block or allow.

The results:

Massive cost reduction and future-proofed fraud prevention

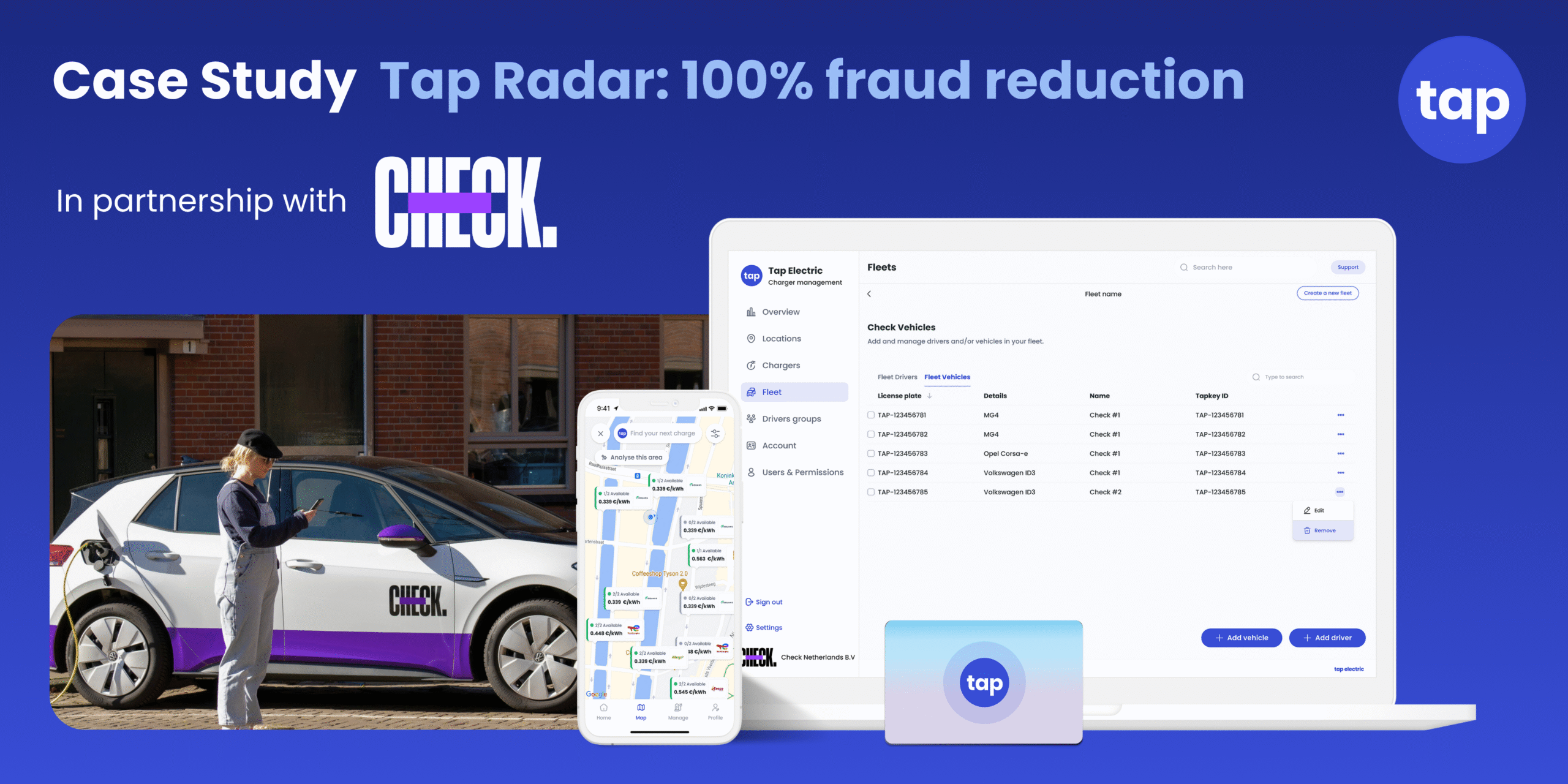

By migrating to Tap Electric, Check achieved:

-

Significant cost savings:

Tap Radar reduced fraud by 100%, eliminating thousands of euros in monthly fraudulent charges. -

Improved operational efficiency:

Tap’s platform APIs provide granular insights into spending and usage, enabling Check to optimise operations, identify trends and make more informed business decisions. -

Futureproof, flexible platform:

Check now has a forward thinking platform ready for future needs like cost controls and network controls.

Head of Operations, Check

Secure your EV fleet charging with Tap